Each year Lynchpin and Econsultancy conduct the “Analytics and Measurement Report”, 900 analysts and digital marketers completed the survey. Now in its eighth edition, the report looks at how organisations are using data strategically and tactically to generate insights and to improve business performance. The research also focuses on the important role for data and analytics in supporting their attempts to build a competitive advantage by becoming more customer-centric.55% of respondents use data effectively to build their understanding of customers but over 60% of companies do not have a formally documented analytics strategy.

- Actionable data recommendations’. Currently, two in every five companies (40%) say more than half of their collated analytics data is useful for driving decision-making, an 8% increase since 2014 and the highest proportion since 2012. However, there has been a significant drop in the number of respondents who say that analytics ‘definitely’ drive actionable recommendations which make a difference to their organisation. Just 23% of respondents were in this camp, compared to 40% last year, a huge decrease of 42%. This is a stark reminder of the difficulty companies face if they want to make data both insightful and useful.

- Tag management and data layers. The 2013 version of this report found that 24% of companies were using tag management systems. Fast forward to 2015 and that number has now more than doubled to 54%. But less than half of companies (46%) have mapped out a data layer for their tag management system, a process which is a prerequisite for successful tag management and data strategies.

- Support from digital analytics vendors. Supporting deployment, translating business requirements into analytics requirements, and training end users are the three areas where the support of vendors is most in demand. Each of these requirements is rated as ‘critical’ by more than half of responding companies. At an overall level, responding companies are significantly more likely to be happy than unhappy with their vendors, and generally respondents are also satisfied with the pace of technology changes.

- Big data technology. Those who have deployed a big data technology solution are still in the minority (11%), but a further 24% are considering one. Among those that use a big data solution, just under half (45%) say they use cloud-based technologies. Just under a third (30%) say they use Hadoop..

About the author

Lynchpin

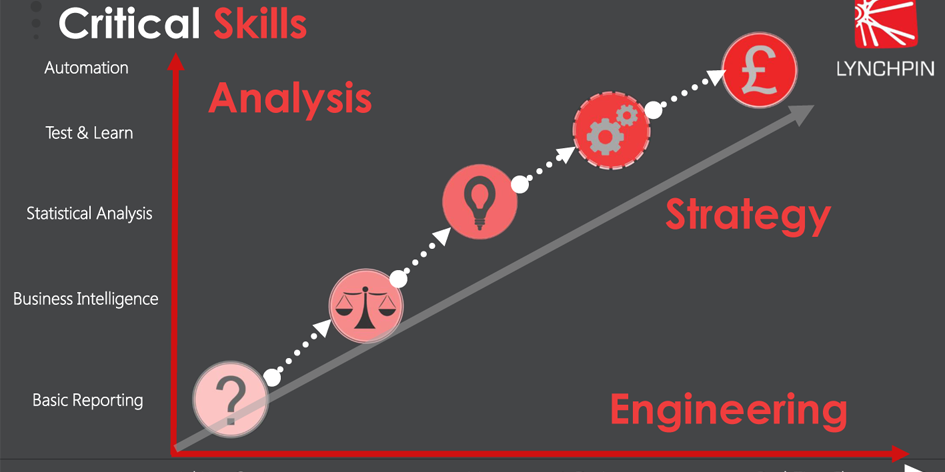

Lynchpin integrates data science, engineering and strategy capabilities to solve our clients’ analytics challenges. By bringing together complementary expertise we help improve long term analytics maturity while delivering practical results in areas such as multichannel measurement, customer segmentation, forecasting, pricing optimisation, attribution and personalisation.

Our services span the full data lifecycle from technology architecture and integration through to advanced analytics and machine learning to drive effective decisions.

We customise our approach to address each client’s unique situation and requirements, extending and complementing their internal capabilities. Our practical experience enables us to effectively bridge the gaps between commercial, analytical, legal and technical teams. The result is a flexible partnership anchored to clear and valuable outcomes for our clients.