Results

- CLV increased by 3% in the first 6 months of the initiative

- Churn was reduced by 18%

- Contact centre save rates were increased by 12%

- Call handling times were reduced by 9%

The Challenge

A financial services client was making some strides in analytics maturity and had developed a Customer Lifetime Value calculation which worked well for the business. However, they faced the challenge of how they could make effective use of this metric. Lynchpin’s objective was to:

- Understand how CLV varies across the client base

- Develop a plan to create a positive impact on the CLV metric

The Solution

With Lynchpin’s expertise in CLV we understood there were 3 key themes which made up the core of Customer Lifetime Value within this organisation.

- How much money do they spend?

- How long do they stay?

- How much do they cost?

In order to influence CLV we needed to draw up some initiatives focussed around these areas and develop advanced analytics solutions to address them via machine learning models.

The initiatives were broken into 3 areas to address the CLV Calculation

- How much money do they spend? -> Grow Revenue

- How long do they stay? -> Increase Customer Retention

- How much do they cost? -> Reduce Costs

For these initiatives to show true success we also consulted with the business on how they could develop customer strategies based on the outputs of the models. The final key to success was in implementing a test and learn framework across all initiatives which looked to constantly monitor and improve model outputs and strategic deployments.

Grow Revenue

Cross-Sell modelling looks at effective ways to help businesses sell additional products or services to existing customers. The objective of cross-sell:

- To increase revenue per customer

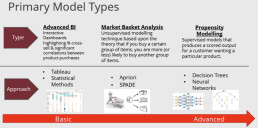

Using a combination of BI and machine learning techniques (such as Apriori and SPADE) and working with the Product team Lynchpin created a suite of models with a core focus on identifying customers with a high propensity to buy more products.

As cross-sell can be deployed at varying different levels it is important to address the business needs for different outcomes. The below diagram shows an example of how cross-sell can be achieved through different methods.

Retain Customers

Lynchpin created Churn models using Decision Trees to predict when customers were most likely to leave. By selecting Decision trees as our model type the outputs were transparent and business focussed allowing Lynchpin to develop strategies for tackling customers who showed signs that they were about to leave.

The Churn model was then deployed through multiple channels including email, call centre and personalised onsite content. Incorporating the churn model with outputs from the cross-sell analyses enabled retention offers focussed on products that the customers were more likely to be interested in and creating a consistent and personalised service.

Reducing Costs

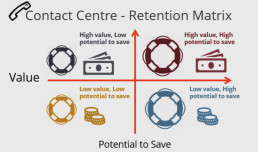

As a business working within the services industry, cost of servicing customers can have a big impact. Lynchpin worked with the Contact Centre team to build predictive models that scored customers on their ‘potential to be saved’. Overlaying CLV with these models we also developed a Retention matrix for the contact centre. The outputs of this model were deployed within the contact centre to allow agents to select the most relevant strategy based on the model recommendations.

Coordinated Customer Strategies

Recognising that the customers needs are at the heart of the solution, it was important that we enabled targeting and personalisation through consistency and timeliness of messaging and propositions across all customer touchpoints.

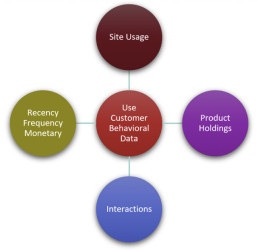

Lynchpin applied K-means clustering techniques on customer behavioural data to identify naturally occurring groups of customers.

This resulted in 6 distinct groups of customers with a clear understanding of who they were. The outputs were uploaded to the customer database and made available across the company. Importantly the clusters were also used to refine and update models for churn and upsell allowing for contact strategies to be

tailored to the individuals.

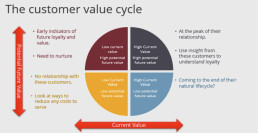

Another important aspect of a customer behaviour is in understanding where they are on their customer life cycle. Working with the Customer Marketing team Lynchpin created a Customer Value Cycle Matrix. The Customer Value cycle utilised aspects of CLV based on their current and future potential value to the

business. Drawing on outputs from our other initiatives further refinement of customer strategies was enabled.

The Results

With the ability to pull many levers on the Customer Lifetime Value metric the organisation was able to have a big impact on overall CLV while also helping to impact core KPIs across multiple areas of the business.

Increase Revenue:

CLV increased by 3% in the first 6 months of the initiative

Retain Customers:

Churn was reduced by 18%

Reduce Costs:

- Contact centre save rates were increased by 12%

- Call handling times were reduced by 10%

An important outcome of the entire project was also felt across the teams in terms of the collaboration and consistent approach to servicing the customer. With the outputs of each model available across the business and coordinated strategies built which resulted in enhancing business area KPIs as well as the over-arching goal of increasing CLV.

About the author

Lynchpin

Lynchpin integrates data science, engineering and strategy capabilities to solve our clients’ analytics challenges. By bringing together complementary expertise we help improve long term analytics maturity while delivering practical results in areas such as multichannel measurement, customer segmentation, forecasting, pricing optimisation, attribution and personalisation.

Our services span the full data lifecycle from technology architecture and integration through to advanced analytics and machine learning to drive effective decisions.

We customise our approach to address each client’s unique situation and requirements, extending and complementing their internal capabilities. Our practical experience enables us to effectively bridge the gaps between commercial, analytical, legal and technical teams. The result is a flexible partnership anchored to clear and valuable outcomes for our clients.